What Is a POS System? Complete Guide to How Point-of-Sale Works

TL;DR

- A POS (Point of Sale) system is a combination of hardware and software that manages sales transactions, inventory, payments, and customer data, serving as the central hub for business operations.

- Modern POS systems have evolved from basic cash registers to cloud-based solutions that offer remote access, real-time reporting, and seamless integration across devices and locations.

- Key POS hardware includes terminals, barcode scanners, card readers, receipt printers, and cash drawers; software options range from on-premise to cloud and mobile solutions.

- POS systems streamline business operations by automating inventory management, providing sales analytics, supporting loyalty programs, and improving customer experience with faster checkouts.

- These systems benefit a wide variety of industries, especially retail, restaurants, salons, and businesses that need to manage both in-store and online sales.

- Additional advantages include secure payment processing, lower hardware costs with cloud solutions, better business insight through analytics, and scalability to support business growth.

If you’ve ever bought anything from a modern retail store or restaurant, you’ve used a POS system. It’s the hub where transactions happen, but it’s so much more than a simple cash register. I’ve spent over a decade helping businesses transition to these systems, and I’ve seen firsthand how the right one can completely transform their operations.

Many new business owners think of a POS as just a way to take money. While that’s its primary job, a modern point-of-sale system is a powerful tool that connects your sales, inventory, customer data, and reporting all in one place. It acts as the central nervous system for your business, giving you the insights you need to grow.

This guide will walk you through everything you need to know about POS systems. We’ll cover what they are, how they work, the different types available, and what to look for when choosing one. By the end, you’ll understand why this technology is a crucial investment for any business, big or small.

What Is a POS System?

So, what is a POS system, really? At its core, a POS system is a combination of hardware and software that businesses use to manage sales transactions. It’s where the customer pays for goods or services, and where the sale is officially recorded.

POS Meaning: Point of Sale Explained

The term “point of sale” refers to the exact place and time a retail transaction is completed. It’s that moment when a customer hands over their money (or card) in exchange for a product. A point of sale system is the technology that facilitates this exchange.

Think of it as the digital evolution of the cash drawer. It handles the payment, calculates the total with taxes, and prints a receipt. But modern systems do much more than that, linking sales data directly to other parts of your business.

How POS Systems Evolved from Cash Registers

The journey from the classic cash register to today’s sleek POS terminals is a fascinating one. The first mechanical cash register, invented in 1879, was designed simply to prevent employee theft by logging every sale. For nearly a century, that was its main purpose.

Then, computers came along. In the 1970s and ’80s, we started seeing computerized cash registers that could scan barcodes and apply discounts. This was a huge leap forward, but the data was still mostly trapped on a single machine.

The real revolution happened with the rise of the internet and cloud computing. Today’s POS systems are networked, intelligent, and accessible from anywhere. They’re no longer just about processing sales; they’re about gathering data and providing actionable insights to help you run your business better.

How Does a POS System Work?

At first glance, a POS transaction looks simple: scan an item, take the payment, and hand over a receipt. But behind the scenes, the system is performing several critical tasks simultaneously.

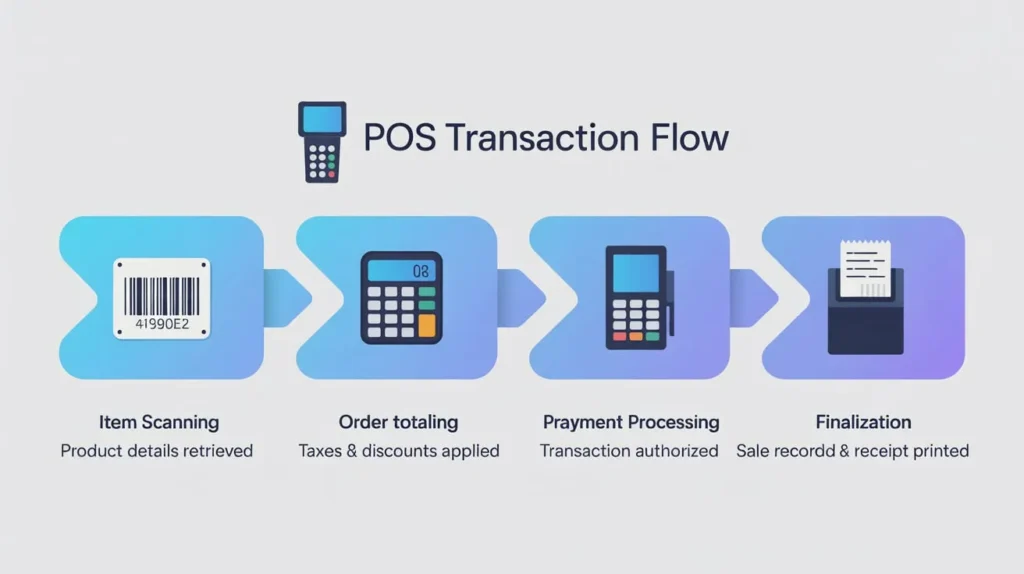

The Transaction Workflow

Let’s break down a typical transaction:

- Item Scanning: A cashier scans the barcode on an item, or finds it in the software interface. The POS software instantly retrieves the product details and price from its database.

- Order Totaling: As items are added, the system calculates the subtotal, applies any relevant taxes or discounts, and presents a final total.

- Payment Processing: The customer pays with cash, a credit/debit card, or a mobile wallet. The POS system securely communicates with the payment processor to authorize the transaction.

- Transaction Finalization: Once the payment is approved, the system logs the sale, prints or emails a digital receipt, and opens the cash drawer if needed.

How POS Connects Sales, Payments, and Inventory

This is where the magic of a modern POS system truly shines. As soon as a transaction is complete, the POS software updates multiple parts of your business in real-time:

- Inventory Management: It automatically deducts the sold items from your inventory count. This helps prevent stockouts and lets you know exactly what you have on hand.

- Sales Reporting: The sale is immediately added to your daily, weekly, and monthly sales reports. You can see which products are selling best and at what times.

- Customer Management: If you have a loyalty program, the system can link the purchase to a customer’s profile, tracking their buying habits and reward points.

This seamless integration saves countless hours of manual work and provides an accurate, up-to-the-minute view of your business’s health.

What Are the Key Components of a POS System?

A complete POS system consists of three main parts: hardware, software, and payment processing.

POS Hardware (Terminals, Scanners, Printers)

The physical components of your system can vary depending on your business type.

- POS Terminal: This is the main screen or monitor where you ring up sales. It can be a dedicated terminal, an iPad, or even a smartphone.

- Barcode Scanner: Speeds up checkout by quickly scanning product barcodes. Essential for most retail businesses.

- Credit Card Reader: Allows you to accept chip cards, contactless payments (like Apple Pay), and traditional magnetic stripe cards.

- Receipt Printer: Prints a physical copy of the transaction for the customer. Many systems now also support digital receipts sent via email or text.

- Cash Drawer: A secure drawer to store cash, which typically opens automatically when a cash transaction is completed.

POS Software (Cloud, Local, Mobile)

The software is the brain of the operation. It’s what runs on your terminal and connects everything.

- On-Premise (Local): The software is installed on a local server at your business. You are responsible for maintaining the server and backing up data.

- Cloud-Based: The software is hosted on the internet, and you access it through a web browser or app. Your data is stored securely online and can be accessed from anywhere.

- Mobile POS (mPOS): This software runs on a smartphone or tablet, turning it into a portable cash register. It’s perfect for pop-up shops, food trucks, or taking payments on the sales floor.

Payment Processing Features

This is the service that communicates transaction information between your business, the customer’s bank, and your bank. A good POS system should offer integrated payment processing, which simplifies setup and ensures all transactions are synced automatically with your sales reports.

What Types of POS Systems Are Available?

POS systems are not one-size-fits-all. They are designed to meet the specific needs of different business environments.

Traditional On-Premise POS

These are the legacy systems you might see in older, larger retail chains. All the data is stored on a local server within the business. While they can be reliable, they are often expensive, difficult to update, and lack the remote access features of modern systems.

Cloud-Based POS

This is the most popular choice for small and medium-sized businesses today. With a cloud POS system, your data is stored securely online. You can access your sales data, manage inventory, and run reports from any device with an internet connection. They are typically sold on a subscription basis, which makes them more affordable upfront.

Mobile and Tablet POS

These systems use tablets (like iPads) or smartphones as the main hardware. They are incredibly flexible and cost-effective, making them a favorite for cafes, food trucks, and small boutiques. They offer the full power of a cloud-based system in a compact, portable package.

Self-Service Kiosk POS

You’ve likely seen these in fast-food restaurants or movie theaters. Self-service kiosks allow customers to place and pay for their own orders without interacting with a cashier. They help reduce wait times and free up staff to focus on other tasks.

Why Do Businesses Use POS Systems?

Moving from a basic cash register to a full-fledged POS system is a significant upgrade. Here are the key benefits that drive businesses to make the switch.

Faster Billing and Checkouts

A streamlined checkout process keeps customers happy. Barcode scanners, intuitive touchscreens, and quick payment processing dramatically reduce transaction times, which is especially important during peak hours.

Real-Time Inventory Tracking

Manual inventory counts are a nightmare. A POS system automates this process, updating stock levels with every sale. You get alerts for low stock, see what’s not selling, and can easily generate purchase orders. This is a game-changer for inventory management.

Sales Reports and Analytics

Knowledge is power. POS systems provide detailed reports that show you more than just total sales. You can analyze sales trends by item, time of day, or even by employee. This data is invaluable for making informed decisions about pricing, promotions, and staffing.

Customer Loyalty and CRM Integration

Modern POS systems often include Customer Relationship Management (CRM) features. You can build customer profiles, track purchase history, and create targeted loyalty programs. This helps you turn one-time buyers into repeat customers.

What Industries Use POS Systems the Most?

While almost any business can benefit from a POS system, they are essential in a few key industries.

Retail Stores

For retail, a POS system is non-negotiable. It manages vast inventories with thousands of SKUs, handles complex promotions, and tracks sales across multiple channels. A good retail POS system is the backbone of the entire operation.

Restaurants and Cafés

A restaurant POS system is designed for the unique workflow of food service. It can manage table layouts, send orders directly to the kitchen, split bills, and track tips. Features like online ordering and delivery integration are also common.

Salons and Service Businesses

Service-based businesses like hair salons or spas use POS systems to manage appointments, track client histories, and sell retail products. They combine a booking calendar with payment processing and staff management tools.

E-commerce + Brick-and-Mortar Hybrids

For businesses that sell both online and in-person, a POS system with e-commerce integration is crucial. It syncs inventory and sales data between your physical store and your online shop, preventing you from selling an item online that you just sold in-store.

What Features Should You Look for in a Modern POS System?

When you’re shopping for a POS system, here are some key features to prioritize.

Cloud Sync

The ability to access your business data from anywhere is a must. A cloud POS system ensures your information is always up-to-date and accessible, whether you’re at the store, at home, or on vacation.

Multi-Store Management

If you have or plan to have more than one location, you need a system that can manage them all from a single dashboard. This allows you to track sales, transfer inventory, and manage employees across all your stores.

Staff Management and Roles

Your POS should let you create different user roles with specific permissions. This ensures employees only have access to the functions they need. You can also track employee hours and run performance reports to see who your top salespeople are.

Secure Payment Integration

Security is paramount. Look for a system that is PCI compliant and uses data encryption to protect your customers’ payment information. End-to-end encryption (E2EE) is the gold standard for protecting sensitive card data.

How Does a POS System Improve Business Efficiency?

A POS system does more than just process sales; it streamlines your entire operation.

Reduced Errors

Manual processes are prone to human error. A POS system automates calculations for pricing, taxes, and discounts, ensuring accuracy and reducing costly mistakes at the checkout.

Better Inventory Control

With real-time inventory tracking, you always know what you have in stock. This prevents you from over-ordering slow-moving items or running out of your bestsellers, saving you money and lost sales.

Accurate Reports for Decision-Making

Instead of guessing, you can make decisions based on hard data. Accurate reports on sales, inventory, and customer behavior give you the confidence to adjust your strategy and grow your business effectively.

What Are the Advantages of Cloud POS Systems?

Over the years, I’ve seen cloud-based POS systems become the dominant choice for most businesses, and for good reason.

Remote Access

This is the biggest advantage. Being able to check on your business from your phone or laptop gives you incredible freedom and control. You don’t have to be physically present to know what’s going on.

Automatic Updates

With a cloud POS, the provider handles all software updates. You automatically get the latest features, security patches, and bug fixes without having to do anything.

Lower Hardware Costs

Cloud systems can often run on affordable hardware like iPads, which significantly reduces your initial investment compared to traditional on-premise systems that require expensive servers.

What Are the Common Challenges of Using POS?

While modern POS systems are incredibly powerful, they aren’t without their challenges.

Hardware Issues

Hardware can fail. Card readers can stop working, and receipt printers can jam. It’s important to choose a provider that offers reliable hardware and responsive customer support when issues arise.

Payment Gateway Downtime

If your internet or payment gateway goes down, you can’t process card payments. Many cloud POS systems have an “offline mode” that allows you to continue taking sales and then syncs them once you’re back online.

Training Staff

A new POS system means a new workflow for your employees. While most modern systems are intuitive, proper training is essential to ensure everyone is comfortable and can use the system efficiently.

How Does POS Security Work?

Protecting customer data is one of your most important responsibilities as a business owner.

Data Encryption

When a credit card is swiped or dipped, the data is encrypted, meaning it’s scrambled into an unreadable code. This protects it from being intercepted by hackers during the transaction process.

PCI Compliance

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards that all businesses that accept card payments must follow. A reputable POS provider will ensure their system is PCI compliant, taking much of the security burden off your shoulders.

User Permissions

Controlling who has access to sensitive information is a key security measure. By setting user permissions, you can prevent unauthorized employees from accessing things like detailed sales reports or customer data.

POS vs Traditional Cash Register – What’s the Difference?

While they both handle money, a POS system and a cash register are worlds apart in terms of capability.

Speed

A POS system with a barcode scanner and integrated payments is significantly faster than manually keying in prices and handling a separate card terminal.

Features

A cash register is a calculator with a cash drawer. A POS system is a comprehensive business management tool that handles inventory, reporting, customer management, and more.

Scalability

A cash register is a standalone device. A POS system can grow with your business, easily expanding to manage multiple locations, online sales, and a growing team.

How Much Does a POS System Cost?

POS pricing typically breaks down into three components.

Hardware Costs

This is the upfront cost of your terminal, scanner, printer, and other physical components. It can range from a few hundred dollars for a simple tablet setup to several thousand for a multi-station system.

Software Subscription Costs

Most cloud-based POS systems charge a monthly or annual subscription fee. This fee typically ranges from $30 to $300 per month, depending on the features you need and the number of registers.

Payment Processing Fees

For every card transaction, you’ll pay a processing fee. This is usually a percentage of the transaction amount plus a small flat fee (e.g., 2.6% + 10¢). These fees can vary between providers, so it’s important to understand the rate structure.

Your Next Step: Grow Your Business

Understanding what a POS system is and how it works is the first step toward modernizing your business. It’s not just about technology; it’s about gaining the control and insight needed to thrive in a competitive market.

Choosing the right system can feel overwhelming, but it boils down to your specific needs. A small café has different requirements than a multi-store retail chain. Take the time to research providers, request demos, and find a partner that can support your growth. The right POS system is an investment that will pay for itself many times over in efficiency, insight, and peace of mind.